President Donald Trump’s latest proposal to slap 100% tariffs on imported pharmaceuticals has set off alarm bells across the health-care industry, consumer advocacy groups, and Wall Street analysts. While Trump frames the policy as a bold move to protect American manufacturing and reduce dependency on foreign drugs, critics warn that the consequences could be devastating—most immediately for U.S. patients who rely on affordable medication.

A Shock Proposal, Delivered Overnight

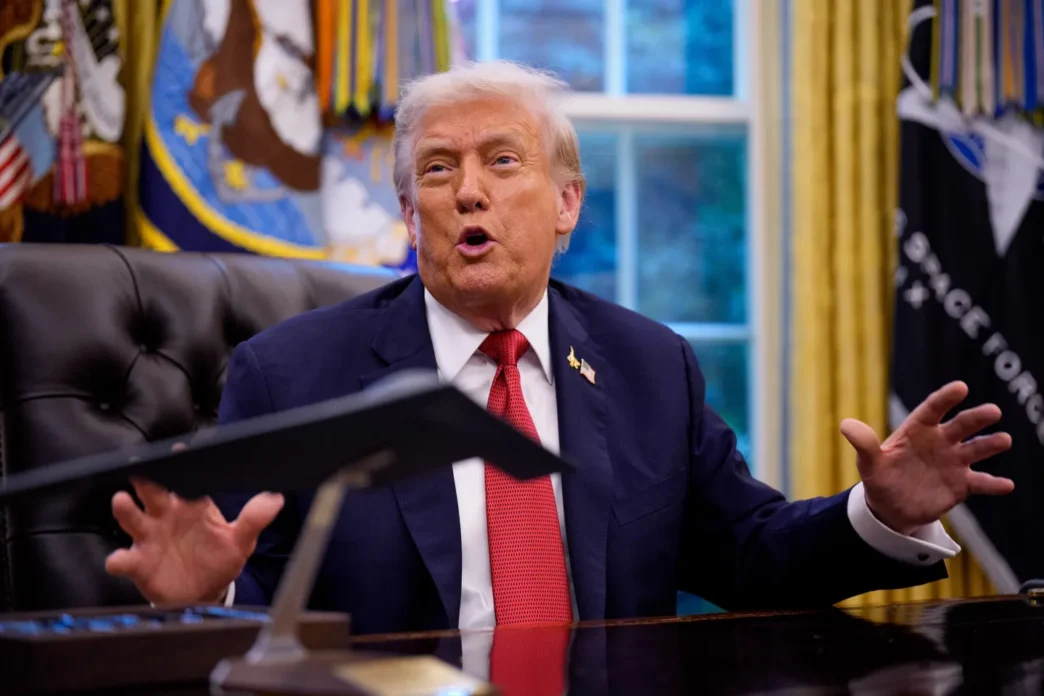

Trump unveiled the proposal abruptly during a late-night campaign address, claiming the measure would “end the drug dependency on hostile nations” and force global pharmaceutical companies to manufacture in the United States. The plan, if enacted, would essentially double the cost of imported drugs overnight.

For a country where nearly 80% of active pharmaceutical ingredients (APIs) are sourced abroad—primarily from India and China—the disruption could be profound.

Analysts Warn of a “Commercial Hit”

A top Wall Street health-care analyst described the proposal as “a meaningful commercial hit for U.S. consumers,”warning that the impact of tariffs would be felt almost immediately in the form of higher prices.

“Tariffs on this scale wouldn’t just affect imports from China; they would fundamentally alter the global supply chain,” the analyst said. “U.S. consumers will be paying significantly more for everything from common antibiotics to life-saving cancer treatments.”

The analyst also noted that even domestic manufacturers depend heavily on foreign-sourced raw materials. A 100% tariff would therefore increase costs across the board, even for drugs technically produced in the U.S.

The Political Rationale

Trump’s push taps into a broader narrative of economic nationalism that has defined much of his policy agenda: reduce reliance on foreign suppliers, revive American manufacturing, and punish trade partners deemed adversarial.

By targeting pharmaceuticals, Trump is moving into a politically sensitive sector—health care—where voters are already anxious about rising costs. The move is designed to resonate with populist frustration but risks backfiring if drug affordability collapses.

Industry Pushback

Pharmaceutical lobby groups have been quick to push back. The Pharmaceutical Research and Manufacturers of America (PhRMA) argued that the tariffs would:

- Disrupt supply chains, leading to shortages of critical medications.

- Increase costs for insurers, Medicare, and Medicaid, pushing government spending higher.

- Delay innovation, as companies divert resources toward mitigating tariff impacts instead of research and development.

One executive put it bluntly: “You don’t fix America’s drug dependency problem by taxing patients.”

Impact on Consumers

The consequences for consumers could be stark:

- Price increases: Everything from blood pressure medication to insulin could see price spikes of 50% or more.

- Insurance strain: Health insurers would pass rising drug costs on to consumers through higher premiums.

- Access issues: Lower-income households could be priced out of vital treatments, exacerbating health inequalities.

- Generics squeeze: Many generic drugs, which keep costs down, are produced overseas. These would be among the hardest hit.

Already, Americans pay some of the highest drug prices in the developed world. A 100% tariff could make the situation untenable for millions.

Global Trade Ramifications

Trump’s tariff threat could also trigger retaliation. Countries that export pharmaceuticals to the U.S. may respond with their own trade barriers, potentially affecting industries far beyond health care—from agriculture to technology.

For India, one of the largest suppliers of generic drugs to the U.S., such tariffs could devastate its pharmaceutical export sector. China, meanwhile, controls a significant share of the global supply of APIs, and any disruption could ripple across international markets.

Markets React

In early trading following the announcement, pharmaceutical stocks fell on concerns about supply disruptions and higher operating costs. Insurers and hospital operators also dipped, as investors priced in higher costs of care. Conversely, U.S.-based drug manufacturers with significant domestic operations saw modest gains, on the theory that tariffs might give them a competitive advantage.

Bond markets also reacted, with investors wary of the inflationary effects of such tariffs on health care, which makes up nearly 20% of U.S. GDP.

Could It Actually Happen?

While Trump’s proposal has garnered headlines, its path to implementation is far from certain. Any such tariff regime would face legal, logistical, and political hurdles:

- Congressional approval may be required, depending on the structure of the tariffs.

- Legal challenges from pharmaceutical companies and trade partners would likely follow immediately.

- Supply chain chaos could force even Republican allies to push back, wary of voter backlash over soaring drug prices.

Nonetheless, analysts caution against dismissing the idea outright, given Trump’s track record of following through on aggressive trade policies.

The Bigger Question

The proposal highlights a fundamental tension: how to balance national security concerns with consumer affordability. There is widespread agreement that America’s reliance on foreign pharmaceutical supply chains poses risks, particularly in emergencies. But the solution, experts argue, is investment in domestic production capacity, not punitive tariffs that make drugs unaffordable.

As one health economist put it: “This is like treating a headache with a guillotine.”

Conclusion

Trump’s overnight demand for 100% tariffs on pharmaceuticals has brought the issue of drug dependency into sharp focus. While the political message is clear—protect U.S. sovereignty and industry—the economic and social consequences could be profound. For consumers, the threat of skyrocketing drug prices looms large, turning what might have been a rallying cry into a potential policy disaster.

The coming months will reveal whether this proposal is a serious policy push or simply another headline-grabbing moment. For now, patients, insurers, and investors alike are bracing for uncertainty.