A New World Order Taking Shape

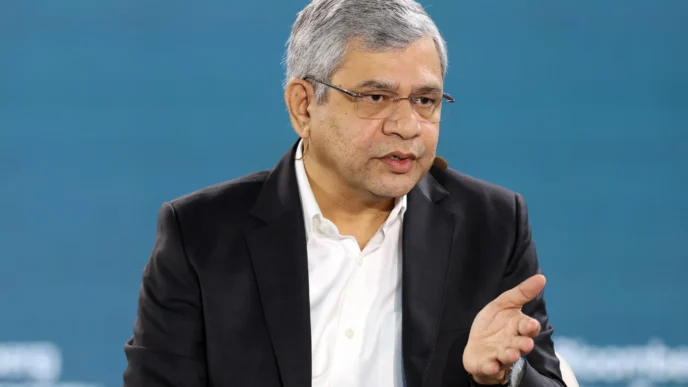

As geopolitical tensions reshape trade, capital flows, and supply chains, HSBC’s CEO has delivered a blunt assessment of the global landscape: the world is fragmenting—and strategic assets are becoming more valuable than ever.

This view reflects a powerful shift in the global economy, where political alignment, national security, and resource control increasingly determine how nations and corporations operate. The age of hyper-globalization is giving way to an era defined by economic blocs, industrial policy, and competition for critical assets ranging from semiconductors to rare earths, data centers, energy infrastructure, and strategic minerals.

HSBC’s perspective carries weight: with operations spanning Europe, Asia, the Middle East, and the Americas, the bank sits at the crossroads of global finance and is uniquely positioned to read the currents of geopolitical change.

Fragmentation: Why the Global Economy Is Splitting Apart

The world is no longer operating under a single, integrated economic system. Instead, nations are reorganizing into competing blocs, often driven by security concerns rather than market efficiency.

1. U.S.–China rivalry defines the new structure

Two economic superpowers are shaping supply chains around competing priorities:

- AI, quantum, and semiconductor races

- National security–based export controls

- Competing regulatory and financial ecosystems

This rivalry is fragmenting everything—from technology flows to investment treaties.

2. Geopolitical conflicts are redrawing trade maps

Russia’s invasion of Ukraine, Middle East instability, and emerging tensions in East Asia have altered energy routes, defense budgets, and investment risk profiles.

3. Re-shoring and friend-shoring

Countries are pulling manufacturing closer to home or to allies. This is reshaping:

- semiconductor fabrication

- pharmaceuticals

- battery production

- critical mineral supply chains

- energy infrastructure

Globalization is becoming selective.

4. Rise of industrial policy

Governments are injecting billions to protect or rebuild strategic sectors:

- U.S. CHIPS Act

- EU Net-Zero Industry Act

- India Production Linked Incentives

- China’s technology and manufacturing subsidies

This is a fundamental departure from laissez-faire globalization.

What HSBC Means by “Strategic Assets”

The CEO’s warning highlights a truth increasingly acknowledged by policymakers and investors: certain assets will define economic power over the next decade.

These include:

1. Semiconductors

The backbone of AI, defense systems, cloud computing, and electronics.

Control of chip production is now a national security imperative.

2. Energy infrastructure

This includes:

- natural gas and LNG terminals

- hydrogen hubs

- nuclear energy

- advanced power grids

- renewable superprojects

Energy security is shaping foreign policy more than at any point since the 1970s.

3. Rare earths and critical minerals

Lithium, cobalt, nickel, copper, neodymium—essential for EVs, missiles, data centers, and consumer electronics.

Countries are racing to secure long-term access.

4. Data infrastructure

Data is now as strategic as oil:

- cloud architecture

- fiber cables

- sovereign data centers

- AI compute clusters

Nations want control over how data is stored, transferred, and processed.

5. Defense and aerospace capabilities

War and instability are redefining defense supply chains. Governments want domestic manufacturing capacity for:

- drones

- guided weapons

- aircraft systems

- radar and satellite networks

6. Water and food security assets

Climate pressures are turning farmland, desalination plants, and water technology into strategic imperatives.

Why Banks Like HSBC Are Paying Attention

The stakes are enormous. The fragmentation trend affects:

A. Capital allocation decisions

Investors are shifting where they deploy money based on:

- geopolitical risk

- supply-chain resilience

- national industrial policies

- energy-security incentives

B. Cross-border financing

Deals that were routine a decade ago now face heightened scrutiny or regulatory barriers.

C. Growth opportunities in new sectors

Fragmentation has created a boom in:

- infrastructure finance

- clean-energy investment

- defense-industry lending

- data-center and digital infrastructure development

Banks must adjust portfolios accordingly.

D. Risks to multinational corporations

Global businesses must navigate different regulatory environments, sanctions, technology regimes, and political priorities.

Winners and Losers in a Fragmented World

Fragmentation creates not only challenges but also new winners.

Winners:

- Nations with energy independence

- Regions controlling critical minerals

- Economies investing heavily in AI and advanced tech

- Financial hubs like Abu Dhabi, Singapore, and Riyadh, which are attracting capital due to geopolitical neutrality

- Companies producing infrastructure, defense technology, clean energy, and semiconductors

Losers:

- Countries dependent on a single trade partner

- Economies reliant on fragile global supply chains

- Companies exposed to U.S.–China regulatory crossfire

- Markets lacking strategic resources or capital buffers

Fragmentation shifts the balance of power.

How Businesses Should Respond

HSBC’s warning is a blueprint for survival in the new era.

1. Reconfigure supply chains

Companies must build resilience:

Multiple suppliers, regional production hubs, and redundancy strategies.

2. Invest in strategic technologies

AI, chips, cybersecurity, automation, and energy systems are must-haves for long-term competitiveness.

3. Strengthen geopolitical risk management

Boards must incorporate geopolitical analysis at the same level as financial and operational assessments.

4. Pivot to markets with stability and capital

The Gulf, India, and Southeast Asia are gaining investor favor as geopolitical middle grounds.

5. Build alliances

Strategic partnerships, joint ventures, and cross-border co-investments reduce vulnerability.

Conclusion: The Global Economy Has Entered a New Era

HSBC’s CEO is not simply observing global change—he is describing a permanent transformation. The world is becoming divided, supply chains are being re-wired, and strategic assets have become the most valuable commodities in geopolitics.

Business leaders who understand this shift—and reposition accordingly—will thrive.

Those who cling to the old era of borderless globalization will be left behind.