The global investment community is transfixed by the transformative power of artificial intelligence (AI). From Silicon Valley to Shenzhen, investors are betting that AI will reshape industries, boost productivity, and redefine economic competitiveness. Yet while most attention has focused on the technology’s impact in developed markets, a growing consensus is emerging among analysts: the real story of AI’s next decade may be told in the world’s emerging economies.

According to new projections from investment strategists, the AI boom is poised to drive the next wave of returns across emerging markets, positioning them as some of the most dynamic beneficiaries of the technology revolution.

AI as a Global Growth Engine

At its core, AI is not just a technological upgrade—it is a general-purpose technology, akin to electricity or the internet. Its potential to optimize supply chains, improve healthcare delivery, and enhance financial inclusion could prove especially transformative in markets where inefficiencies remain entrenched.

“Emerging markets can leapfrog stages of development by deploying AI in areas like education, finance, and manufacturing,” said one analyst from a leading global bank. “This is where we’re likely to see some of the most exciting productivity gains over the next decade.”

Why Emerging Markets Stand to Gain

Several structural factors give emerging economies a unique opportunity to capitalize on AI adoption:

- Demographic Dividend: Many emerging markets, particularly in Asia, Africa, and Latin America, have young, tech-savvy populations eager to adopt new tools.

- Rapid Digitization: With fewer legacy systems than developed markets, emerging economies can implement AI-enabled technologies more quickly and at lower cost.

- Government Investment: Countries such as India, Brazil, and the UAE are rolling out national AI strategies, offering tax incentives, research funding, and digital infrastructure to attract investment.

- Sectoral Impact: Industries critical to emerging economies—such as agriculture, manufacturing, and logistics—are especially ripe for AI-driven efficiency improvements.

Regional Outlook

- Asia: India is positioning itself as a global AI hub, with startups using machine learning for everything from crop monitoring to financial inclusion. Meanwhile, Southeast Asian nations like Vietnam and Indonesia are attracting record foreign investment in tech infrastructure.

- Middle East: Saudi Arabia and the UAE are leveraging sovereign wealth funds to invest heavily in AI, both domestically and abroad, as part of diversification plans away from oil dependency.

- Latin America: Brazil and Mexico are seeing AI adoption in fintech and supply chain optimization, key sectors for their economic stability.

- Africa: Kenya, Nigeria, and South Africa are harnessing AI to leapfrog traditional banking through mobile money ecosystems, while also applying AI to agriculture and healthcare challenges.

Investment Implications

For investors, the emerging-market AI story is more than just a narrative. Capital flows are beginning to reflect confidence in this theme:

- Equities: Tech-heavy indexes in markets such as India and Taiwan are outperforming global benchmarks.

- Venture Capital: AI startups in emerging economies are attracting record funding rounds, particularly in fintech and e-commerce.

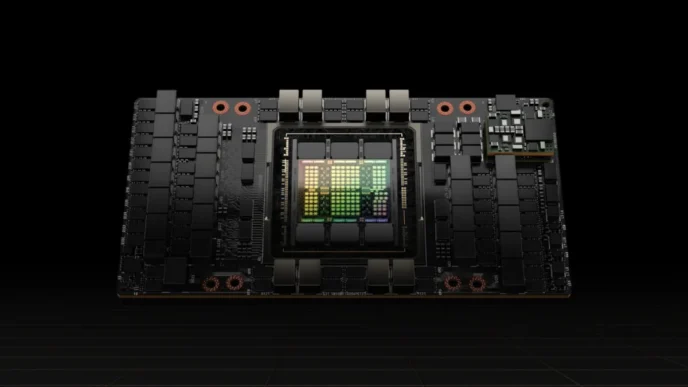

- Infrastructure: Demand for data centers, cloud services, and semiconductor imports is expected to surge across developing economies.

Still, risks remain. Political instability, regulatory uncertainty, and uneven digital infrastructure could slow adoption in certain regions. Investors will need to be selective, targeting countries with both political stability and proactive AI strategies.

Balancing Risks and Opportunities

While Wall Street has lavished attention on the “Magnificent Seven” tech giants driving AI adoption in the US, emerging markets offer undervalued entry points into the same transformative trend. Analysts note that AI-linked productivity gains in emerging economies could outpace those in developed markets, provided that governments maintain a stable policy environment and continue investing in infrastructure.

That said, challenges are real:

- Digital divides between urban and rural areas could exacerbate inequality.

- Cybersecurity threats may grow as AI adoption outpaces regulation.

- Dependency on foreign technologies could leave some markets vulnerable to geopolitical shifts.

A Decade of Transformation Ahead

If the AI boom delivers on its promise, the 2020s may mark a golden decade for emerging-market returns. From boosting farm yields in Africa to automating manufacturing in Southeast Asia and powering financial inclusion in Latin America, AI could serve as the great equalizer—allowing emerging economies to narrow the gap with developed nations while offering global investors significant upside.

The world’s largest technology revolution in decades is not confined to Silicon Valley or Wall Street. Increasingly, its next chapter will be written in Mumbai, São Paulo, Nairobi, and Dubai.

Conclusion

Artificial intelligence is not just a tool for boosting profits in advanced economies—it is a force that could reshape the growth trajectories of entire nations. For emerging markets, AI represents both a challenge and a historic opportunity. For investors, it offers a new frontier of returns, albeit with the need for careful navigation of risks.

If the projections hold true, the AI boom will not just redefine industries—it may redefine the global balance of economic power.